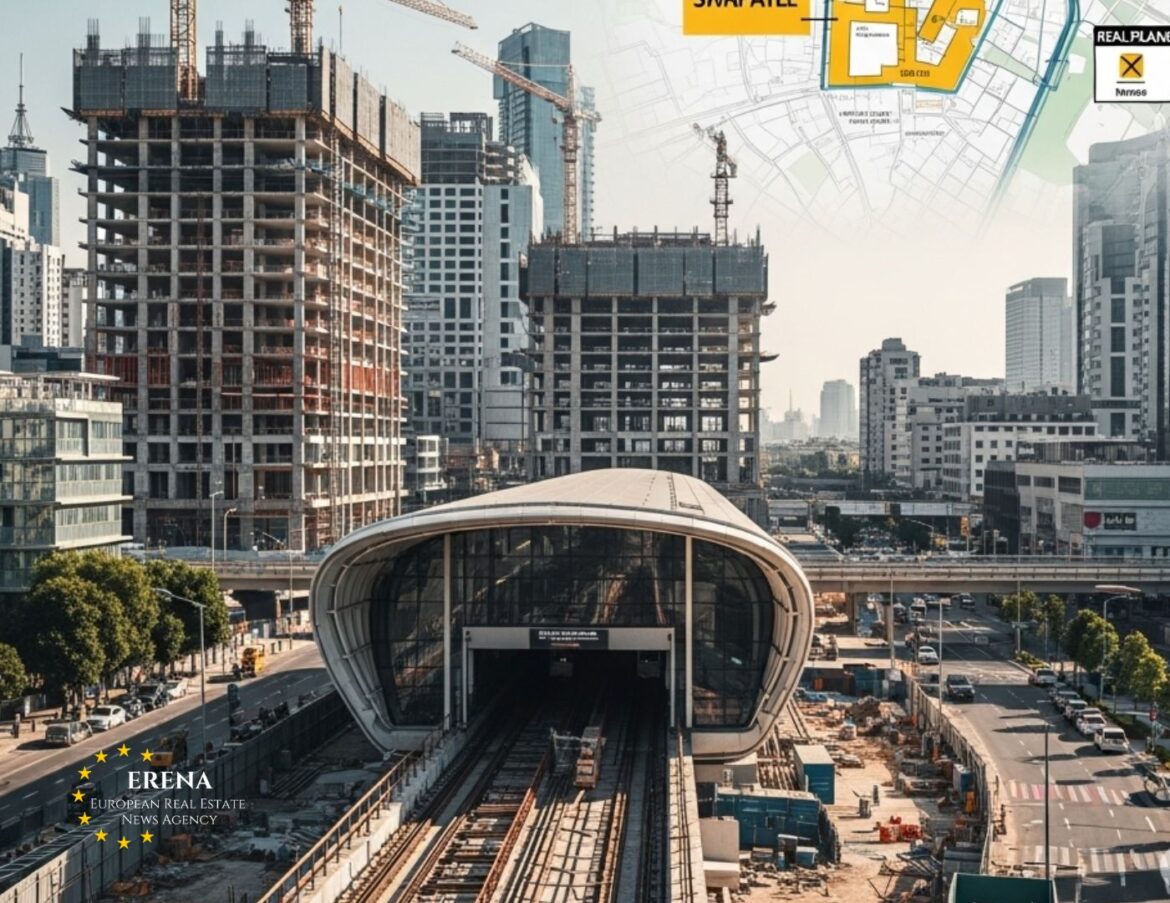

The expansion of metro lines has long surpassed the realm of basic infrastructure development. Today, it’s a powerful catalyst for urban transformation and a clear signal for booming local property markets. Investors, developers, and homebuyers alike increasingly view upcoming metro stations as indicators of rising property values, economic renewal, and long-term rental potential. From Barcelona to Warsaw, Athens to Berlin, areas targeted for metro expansion are rapidly turning into real estate hot spots.

Infrastructure as a Capital Magnet

Urban mobility remains one of the most influential factors driving demand for both residential and commercial properties. A new metro station doesn’t just cut commuting time—it significantly boosts the attractiveness of an entire neighborhood. Businesses follow. Populations increase. Land values soar.

According to JLL, real estate located within 500 meters of a new metro station in European cities may increase in value by 8–15% within the first two years after opening. Over a five-to-ten-year horizon, appreciation can reach 25–30%.

Case Studies: Capital City Growth

Vienna: Line U5 Revitalizes Outlying Districts

Vienna’s U5 metro extension project, launched in 2021, targets low-density residential neighborhoods. By 2025, areas near planned stations like Frankhplatz and Elterleinplatz are seeing apartment prices rise to €4,800–€5,300 per m², up from under €3,700 per m² just a few years ago.

Athens: Line 4 Sparks New Life in Older Areas

The Greek capital’s new Line 4 is generating buzz in neighborhoods once considered less desirable, including Kypseli, Vyronas, and Galatsi. Local agencies report average housing prices in proximity to future stations have increased by 12–18% in just two years, reaching €2,300–€2,800 per m². Both local buyers and foreign investors are taking notice.

Berlin: U-Bahn Heads Southeast

Districts slated for the U7 extension toward Berlin Brandenburg Airport are already experiencing a developer surge. In areas like Rudow and Neukölln, where new stations are planned, residential prices have climbed 10–14% in the past 18 months.

What’s Happening in the Rental Market?

Rental demand tends to follow closely behind metro expansions. Once-remote neighborhoods become viable for young professionals, students, and families, causing rental prices to rise—on average, 8–12% within a year of a new station opening.

Take the Grand Paris Express: this massive metro project is connecting outlying suburbs to central Paris. In once-overlooked areas like Clichy-sous-Bois and Bondy, the monthly rent for a one-bedroom flat has jumped from €650 to €780 in just twelve months.

Developers Follow the Rails

Developers closely track metro expansion plans and often launch residential projects even before the lines are operational. This early action allows them to offer competitive prices ahead of the anticipated value jump.

In Madrid, where Line 11 is being extended, developers are actively building in Villa de Vallecas and Puente de Vallecas. New apartments are currently selling for €2,500/m², with projections reaching €3,200–€3,500/m² once the line is completed in 2027.

The Green Advantage

Metro expansion isn’t just an economic play—it’s also a sustainability strategy. Fewer cars mean reduced carbon emissions and cleaner, more livable cities. European urban centers striving for climate neutrality are fully behind transit-oriented development, encouraging eco-friendly construction near new stations.

In Oslo, the T-bane expansion is being implemented alongside an energy-efficient housing initiative. Homes within 750 meters of the new stations must meet green standards, feature low vehicle density, and incorporate green space planning.

Risks to Watch

Despite the benefits, smart investors consider the potential risks:

- Construction delays can stall appreciation for years

- Oversupply near new stations could lead to rental competition

- Lack of amenities might undermine the appeal despite improved transport

Investors are wise to look beyond metro maps alone and evaluate city planning, commercial infrastructure, and local development strategies.

Who Benefits?

- Early-stage investors – get the highest return on resale

- Families – enjoy improved quality of life without overpaying

- Landlords – can expect stable demand and rental growth

- Cities – benefit from investment, revitalization, and increased tax revenues

Conclusion

Metro expansion zones are quickly becoming magnets for real estate activity. As Europe’s major cities push forward with ambitious transportation plans, properties near future stations represent true real estate gold for the years to come. Smart investment near planned metro lines offers not only a hedge against inflation but also the potential for strong capital appreciation.

For anyone seeking stable, long-term returns in 2025 and beyond, buying near tomorrow’s transit hubs remains one of the savviest strategies in European real estate.